nd sales tax exemption form

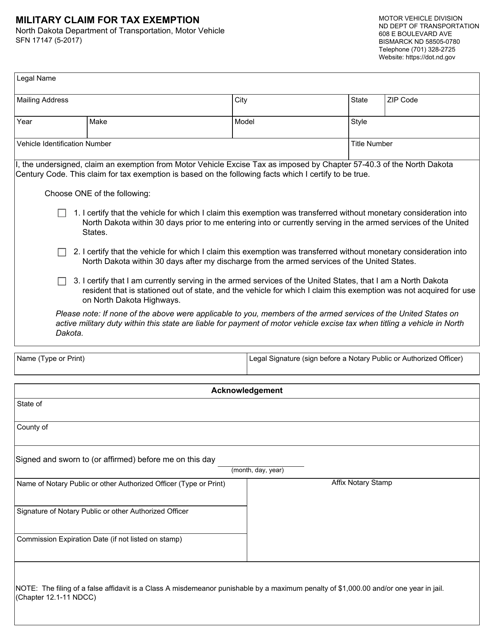

Call Now To Have Your Questions Answered. MILITARY CLAIM FOR TAX EXEMPTION North Dakota Department of Transportation Motor Vehicle SFN 17147 5-2017 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E.

51 rows items shipped to north dakota qualify for a tax exemption.

. 2 Get a resale certificate fast. APPLICATION FOR SALES TAX EXEMPTION CERTIFICATE OFFICE OF STATE TAX COMMISSIONER. For purchases made by a North Dakota exempt entity the purchasers tax.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. Ad 1 Fill out a simple application. Use this form only for application for a life science animal-use certified company in the state of North Dakota by the North Dakota Department of Commerce Division of.

This is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a processing facility in North Dakota that produces liquefied natural gas. North Dakota Tax Exempt Form. The credit is equal to a.

This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax. And will be used for tax reporting identification and administration of. While the North Dakota sales tax of 5 applies to most transactions there are certain items that may be exempt from taxation.

Services are subject to the state sales tax plus applicable municipal tax unless exempt from sales tax. Registered users will be able to file and remit. How to use sales tax exemption certificates in North Dakota.

Double check all the fillable fields to ensure full precision. An individual estate trust partnership corporation or limited liability company is allowed an income tax credit for conducting research in North Dakota. Complete this certifi cate and give it to the seller.

Streamlined Sales and Use Tax Agreement - North Dakota Certifi cate of Exemption Purchaser. The sales tax is paid by the purchaser and collected by the seller. Ad Shop Plumbing Heating HVAC Supplies From Premium Brands Including Honeywell Uponor.

Trusted By Tradespeople and Professionals. Form 306 - Income Tax Withholding Return. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to.

Streamlined Sales Tax Agreement Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950. OFFICE OF STATE TAX COMMISSIONER CERTIFICATE OF RESALE SFN 21950 11-2002 I hereby certify that I hold _____ Sales and Use Tax permit number_____.

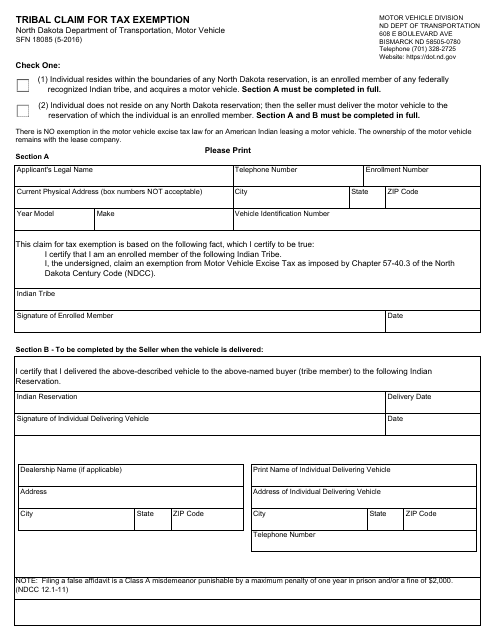

TRIBAL CLAIM FOR TAX EXEMPTION North Dakota Department of Transportation Motor Vehicle SFN 18085 5-2016 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now.

This page discusses various sales tax exemptions in North. The Office of State Tax Commissioner is required by law to disclose the amount of any tax incentive or exemption claimed by a taxpayer upon. I am engaged in the business.

Steps for filling out the SFN 21950 North Dakota Certificate of Resale. The letter should include. There are three reasons why a sale may be exempt from sales or use tax.

A new or expanding plant may be exempt from sales and use tax. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

Ad 1 Fill out a simple application. Ad Sales Tax Exemption Wholesale License Reseller Permit Businesses Registration. Step 2 Enter.

Sales Tax Exemption Simple Online Application. 2 Get a resale certificate fast. North Dakota provides sales tax exemptions for equipment and materials used in manufacturing and other targeted industries.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of. Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax.

Send the completed form to the seller and keep a. If this certifi cate is not fully. North Dakota sales tax is comprised of 2 parts.

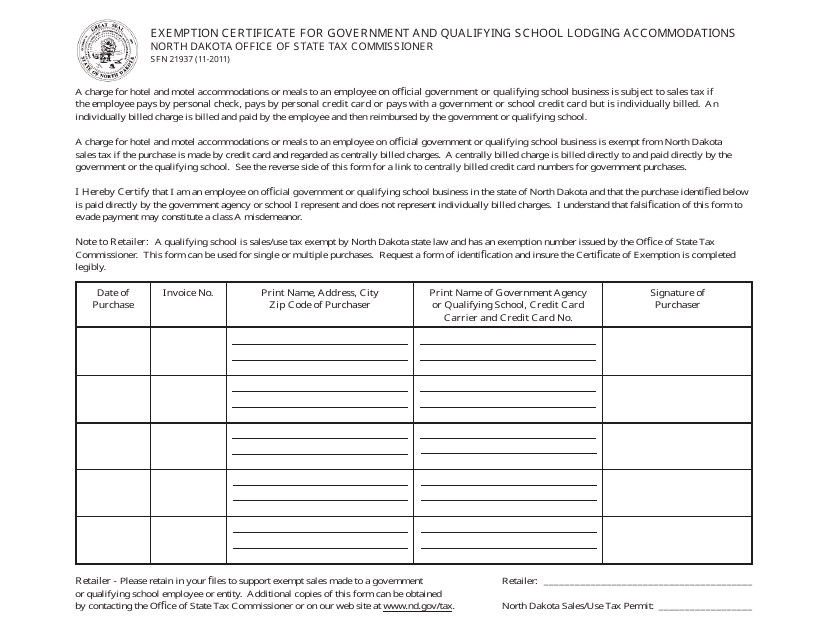

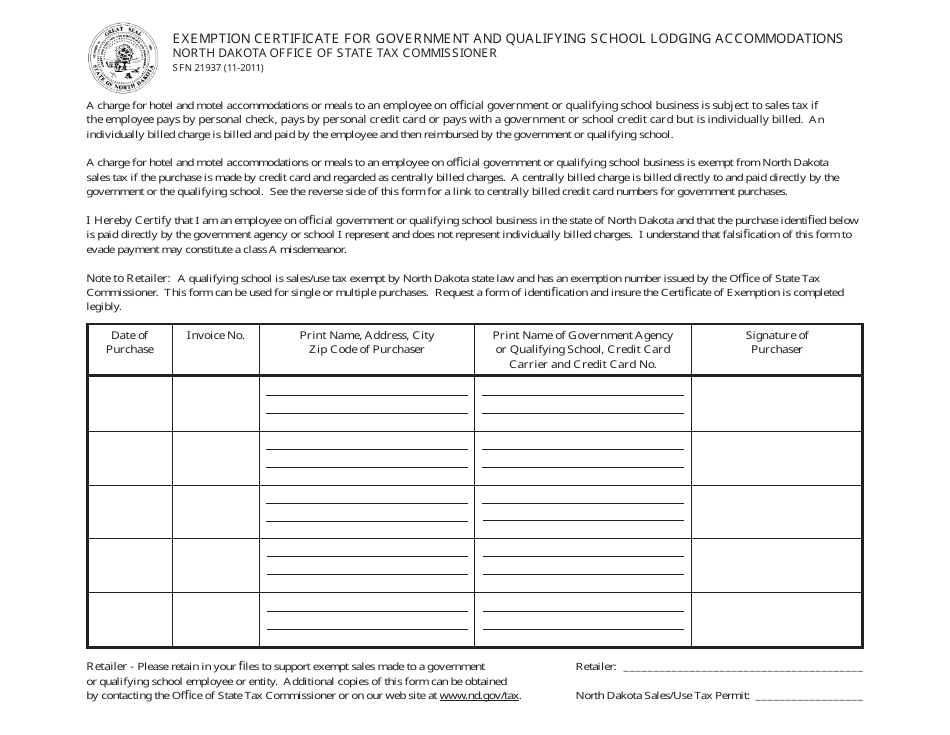

Form Sfn21937 Download Fillable Pdf Or Fill Online Exemption Certificate For Government And Qualifying School Lodging Accommodations North Dakota Templateroller

How To Use A North Dakota Resale Certificate Taxjar

Form Sfn21937 Download Fillable Pdf Or Fill Online Exemption Certificate For Government And Qualifying School Lodging Accommodations North Dakota Templateroller

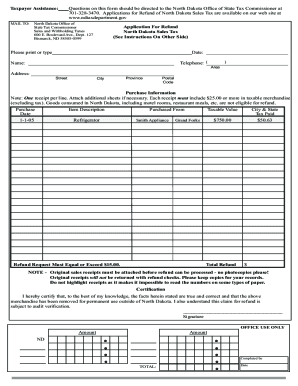

North Dakota Tax Refund Canada Fill Out And Sign Printable Pdf Template Signnow

Nd Form St 2016 2022 Fill Out Tax Template Online Us Legal Forms

North Dakota Kheops International

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Form Sfn17147 Download Fillable Pdf Or Fill Online Military Claim For Tax Exemption North Dakota Templateroller

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

Kulm Nd Town History Supplement 1892 1967 Grhs Home Page

Form 21919 Application For Sales Tax Exemption Certificate

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com